idfc bank toll-free number– IDFC First Bank is an Indian private-sector bank headquartered in Mumbai. It was formed in 2015 by the demerger of the infrastructure lending business of IDFC Limited, a leading infrastructure financing company, into a new entity. In 2018, IDFC First Bank merged with Capital First, another private sector bank, to create a more diversified financial institution.

Table of Contents

Introduction

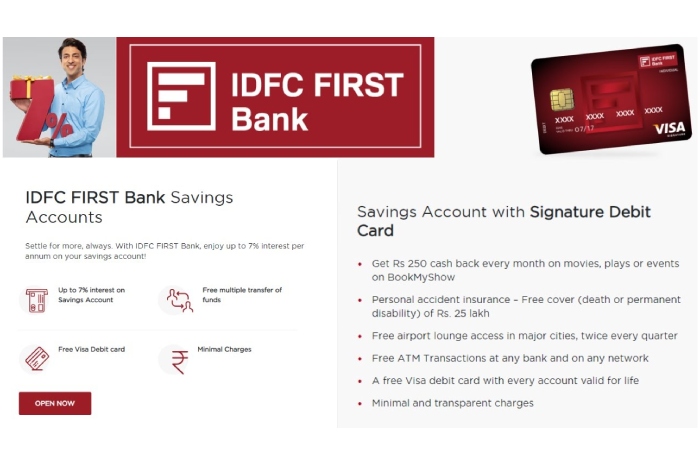

IDFC First Bank offers its customers a wide change of banking and financial services, including savings accounts, fixed deposits, loans, investment products, and insurance. Henceforth, the bank strongly focuses on digital banking, and its mobile app is one of the most popular in India.

However, IDFC First Bank is a well-respected institution with a strong track record. It is rated AA- by CRISIL and A1+ by CARE. And also the bank has also recognized by several industry awards, including the “Best Private Bank in India” award by The Banker magazine.

Key Features of IDFC First Bank

Mentioned below are some key factors indulged by IDFC

- Strong focus on digital banking

- Wide range of banking and financial services

- Good track record and financial strength

- Recognized by industry awards

However, If you are looking for a reliable and innovative bank with a strong focus on digital banking, IDFC First Bank is a good option.

Products and Services rendered by IDFC

Here are some of the products and services offered by IDFC First Bank:

- Savings accounts

- Fixed deposits

- Loans (personal, home, car, etc.)

- Investment products (mutual funds, bonds, etc.)

- Insurance (life, health, etc.)

- Digital banking services (mobile app, internet banking, etc.)

Pros and Cons Inculcating IDFC

IDFC First Bank has a network of over 500 branches and 1,500 ATMs across India. However, The bank also offers services through its mobile app and Internet banking platform.

Here are the pros and cons of IDFC Bank’s toll-free number:

Pros:

- A convenient and affordable way to reach customer service 24/7

- English and Hindi-speaking agents available

- It can used to make inquiries, report problems, or file complaints

- It can be used to access a variety of self-service features, such as account balance inquiries and bill payments

Cons:

- Long wait times during peak hours

- May not be able to resolve complex issues over the phone

- Some features may only be available to customers who have registered for online banking

Some additional tips for using IDFC Bank’s toll-free number

- If you have a simple question, try using the bank’s online FAQs or chat feature before calling customer service.

- If you are calling during peak hours, try calling early in the morning or late at night.

- Prepare to provide your account number and other relevant information when you call.

- If you cannot resolve your issue over the phone, ask the agent to send you a follow-up email.

IDFC Bank’s toll-free number, 1800 10 888, offers several benefits to customers, including

- Convenience: Customers can call the toll-free number from anywhere in India, 24 hours a day, seven days a week.

- Peace of mind: Customers can be confident that their calls will answered by a qualified customer service representative who can help them with their banking needs.

- Cost-effectiveness: The toll-free number is free for customers to call to save money on long-distance charges.

- Efficiency: Customers can get their banking questions answered quickly and easily without waiting in line at a branch.

Concerned Specified Services Via IDFC

Here are some of the specific services that customers can access through IDFC Bank’s toll-free number:

- Account balance inquiries

- Fund transfers

- Cheque book requests

- Credit card enquiries

- Loan enquiries

- Complaint resolution

However, If you are an IDFC Bank customer, I encourage you to take advantage of the toll-free number. It is a convenient, cost-effective, and efficient way to get your banking questions answered.

Here are some additional benefits of using IDFC Bank’s toll-free number

- You can speak to a customer service typical in your preferred language.

- And also You can access the latest information about IDFC Bank’s products and services.

- By this You can provide feedback about your banking experience.

conclusion

Overall, IDFC Bank’s toll-free number is a convenient and affordable way to reach customer service. However, it is important to be aware of the potential drawbacks, such as long wait times during peak hours. If you are interested in opening an account with IDFC First Bank, you can do so online or at any of the bank’s branch. You can also communication the bank’s customer care helpline for assistance.